are political contributions tax deductible in oregon

Charitable contributions claimed as Oregon tax payments. Note that there is a difference between the two.

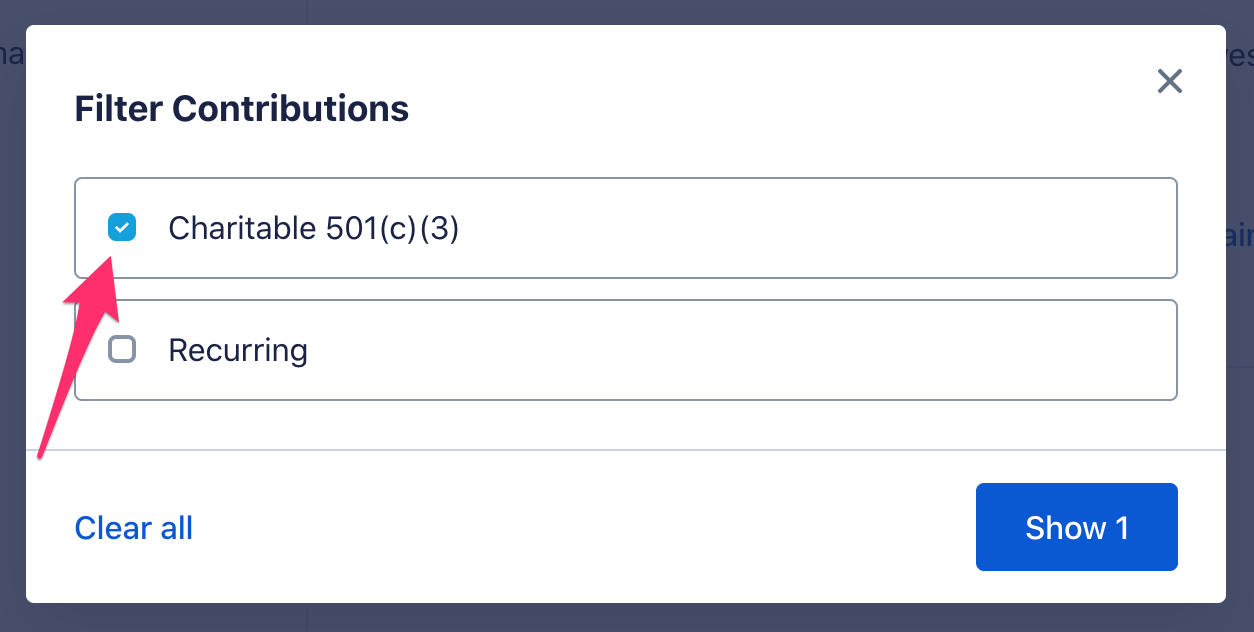

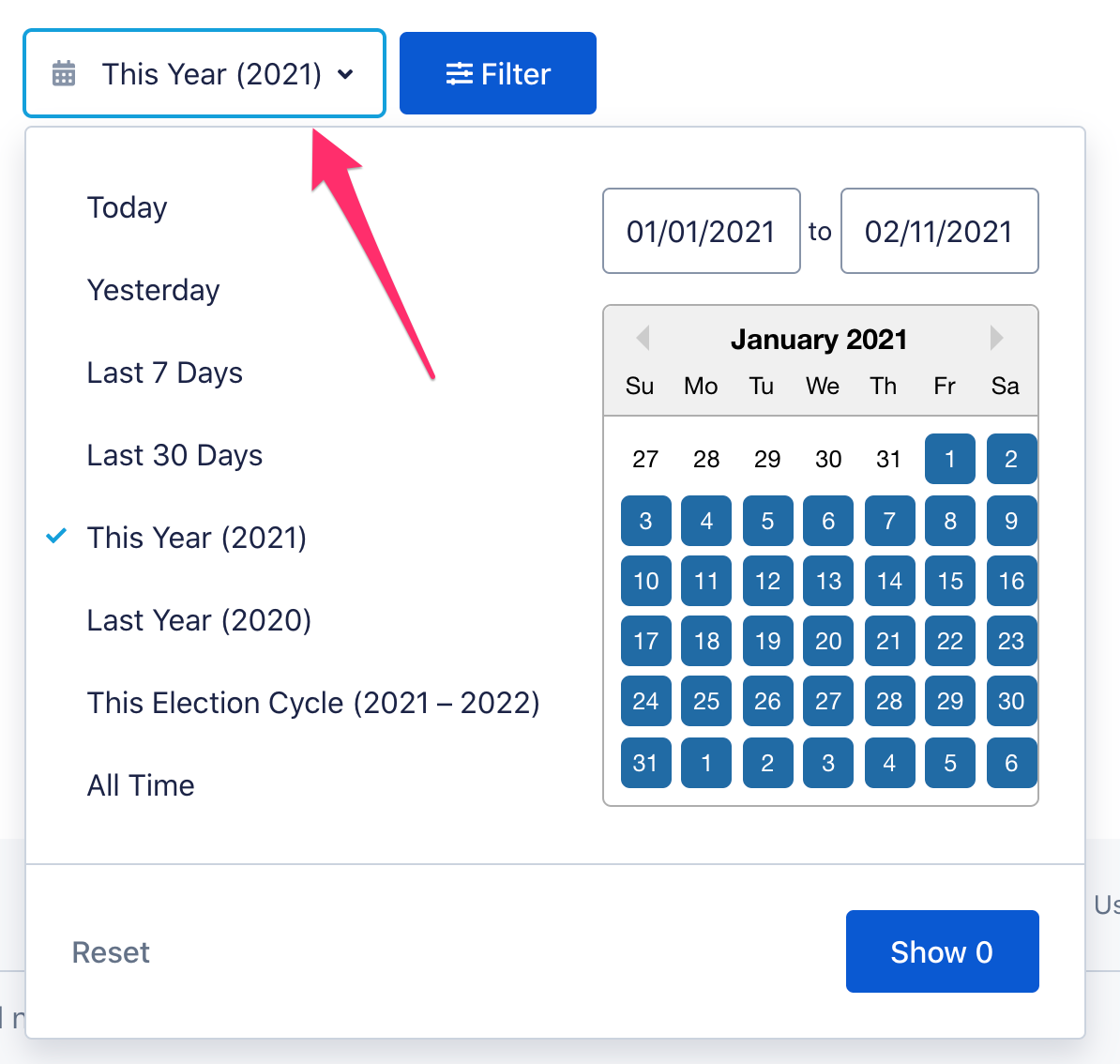

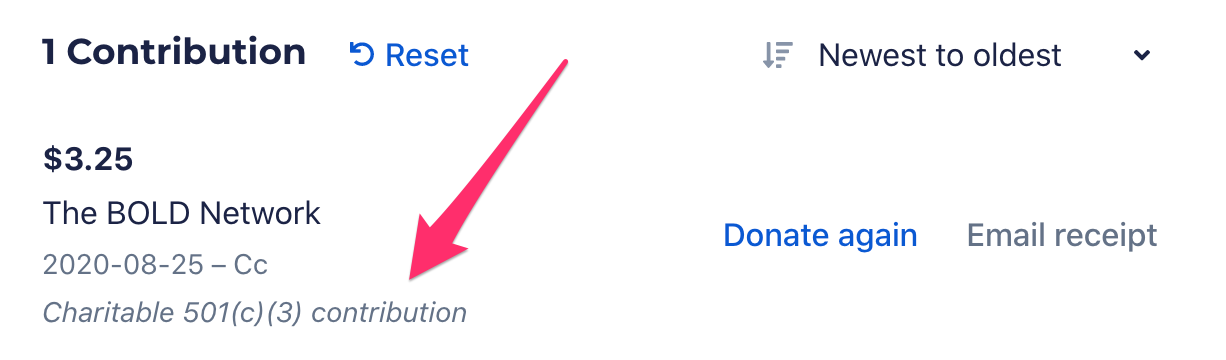

Are My Donations Tax Deductible Actblue Support

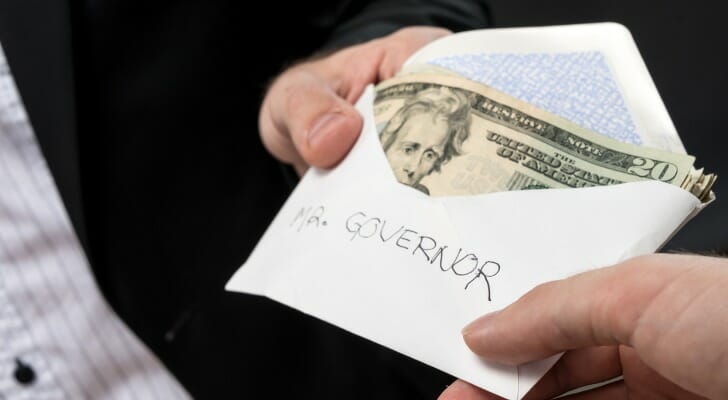

To qualify for the political contribution credit the contribution must be a voluntary contribution of money made to one of the following.

. Political donations are not tax-deductible but contributions to churches mosques temples or other religious groups are taxed. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. You can only claim deductions for contributions made to qualifying organizations.

January 30 2022 1045 AM. ModificationsSchedule OR-ASC-NP section D Code. A declaration of candidacy in November 2011 and appeared on the ballot for the 2012 primary election as a candidate for Oregon state senator.

Consult your tax advisor for more information. Businesses may be interested in political outcomes but will not be able to deduct expenses related to political campaigns. Individuals can donate up to 2900 to a candidate committee per election up to 5000 per year to a PAC and up to 10000 per year to a local or district party committee.

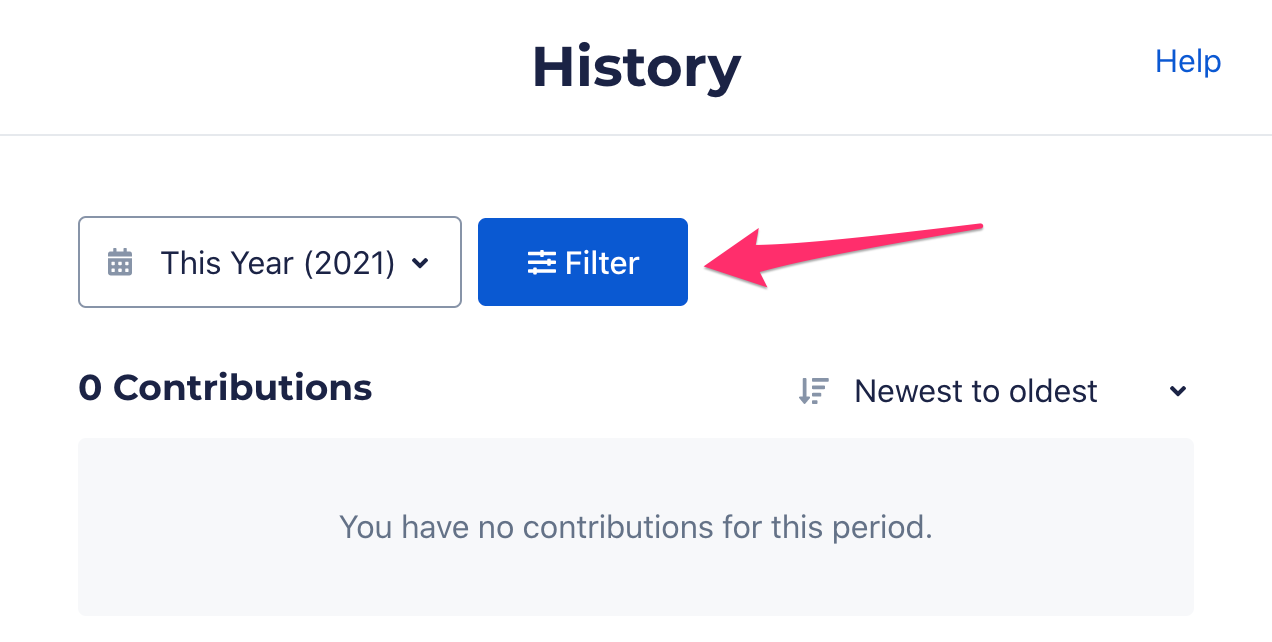

Political contributions deductible status is a myth. According to Political contributions credit in Oregons Publication OR-17 Individual Income Tax Guide The AGI limit for claiming this credit has been lowered to 150000 for married taxpayers filing a joint return and 75000 for all others. Federal income tax paid for a prior year.

Political Campaigns Are Not Registered Charities. All four states have rules and limitations around the tax break. Please note that current Oregon law allows individuals with an adjusted gross income of less than 75000 or joint filers with a combined income of less than 150000 to claim the Political Tax Credit.

Artists charitable contribution reported on the nonresident return form 600. Montana offers a tax deduction. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations.

Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. You are to itemize your taxes on form 1040 Schedule A. These taxes should be documented and kept for future reference.

You cant deduct a charitable contribution for which you received an Oregon tax credit as a payment of Oregon. Federal income tax refunds. Here are the main reasons why.

This form itemizes your taxes to understand better what is or is not tax deductible. Even though political contributions are not tax-deductible there are still restrictions on how much individuals can donate to political campaigns. Shell report 16000 28000 12000 on Schedule OR-A line 5.

Oregon Family Council PAC gifts are not a charitable deduction for income tax purposes. Oregon deduction for taxes paid to Maine by 12000. Federal AGI limit has been reduced to 15000 for joint filing but Turbo.

Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities. These are non tax-deductible contributions if you donate to a political party campaign or political action committee. The amendments to ORS 316102 Credit for political contributions by section 49 of this 2019 Act apply to tax years beginning on or after January 1 2020 and before January 1 2026.

This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. Credit for Political Contributions 1 In General. Part-year and nonresident filers report these deductions and modifications on Schedule OR-ASC-NP.

As of 2020 four states have provisions for dealing with political contributions. Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. All contributions donations or payments to political organizations are not tax-deductible.

Arkansas Ohio and Oregon offer tax credits.

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible H R Block

States With Tax Credits For Political Campaign Contributions Money

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible Smartasset

Are My Donations Tax Deductible Actblue Support

Money S Power In Politics Give Everyone A Share Cnn

Are Political Contributions Tax Deductible Smartasset

Are Political Donations Tax Deductible Credit Karma

Are Political Contributions Tax Deductible Smartasset

Why Political Contributions Are Not Tax Deductible

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Why Political Contributions Are Not Tax Deductible